I recently listened to a podcast with heavyweight boxer Tyson Fury on one of the podcasts I follow. He said something that might surprise many, but not me. After winning the heavyweight championship, the pinnacle of what he dedicated his life to, he lived the worst depression he had ever experienced (having a history with the disorder). He had the belt, money, notoriety, yet he couldn't get himself out of bed. He would go to the gym, but had no fire any longer. The feelings got worse. He didn't want to box; he didn't want to live. The only time he didn't feel down was when he was drinking and taking drugs. The effects of the drugs masked the negative feelings. But when that hangover came, the depression had a heavier grip on him. He soon found himself weighing 400 lbs. They stripped him of his title.

But he's making a comeback. And having goals, getting rid of drugs, and getting the natural high from an active lifestyle has him living, and sometimes loving, life again.

I've touched on my mental health a few times in this blog. I sit here right now, thankful that I've been on a good run. This has been a great year as far as that is concerned. I have a few things to thank for this -

But he's making a comeback. And having goals, getting rid of drugs, and getting the natural high from an active lifestyle has him living, and sometimes loving, life again.

A structured routine in life is key - having short-term and long-term goals. I advise living a healthy, clean life. There is nothing better than getting in the gym and getting the endorphins going. I don't suffer from mental health problems when I'm active and I have a goal. -Tyson Fury

Jim Carrey was one of my favorite comedic actors growing up, and has morphed in to one of my favorite humans existing today. He said something that is incredibly simple, yet I think the majority of people today could benefit from. "I think everybody should get rich and famous and do everything they ever dreamed of so they could realize that it's not the answer." Jim represents another individual who accomplished everything he could have imagined, yet battled depression at the peak of his career.

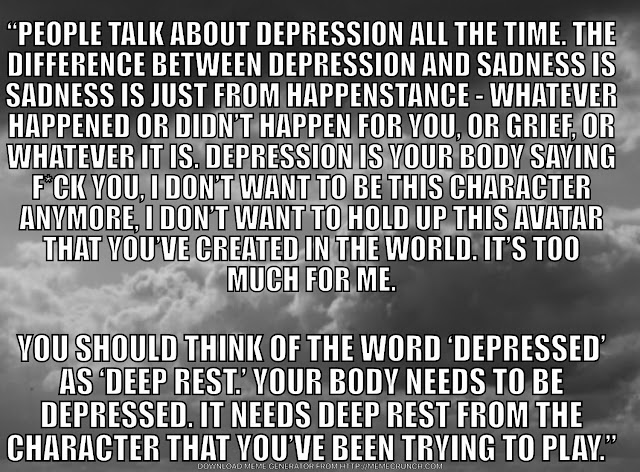

Here is another quote from Jim -

I've touched on my mental health a few times in this blog. I sit here right now, thankful that I've been on a good run. This has been a great year as far as that is concerned. I have a few things to thank for this -

- Long and short term goals. This financial journey has been powerful. It's a series of short term goals, with eventual long term implications. It gives me focus. It gives me something to look forward to. This exists with another powerful set of short and long term goals - my fitness journey. I dare say I'm in the best shape I've been in since college. I hit 17.1 miles run this week, with a running template that will slowly add to this total for the next 17 weeks. The runners high is real. I firmly believe many, many people would benefit from being more active. The body and brain crave it. It has a special ability to evaporate stress. You sleep better.

- At 35 years old, I'm beginning to dig deep and unearth who I AM. Who I REALLY am. There is nothing more exhausting than playing a character in life. An illusion of someone or something you think you OUGHT to be. To act a certain way, hoping desperately to be accepted by others. I've been brought to heavy tears letting this energy build for too long. I learned I had to have a better relationship with myself, absent any of the superficial things that we wrongly let impact how much we value ourselves and the life we're given to experience. It could be said that improvement in this area of my life is a product of getting older, but I believe there are many people advanced in age who still struggle with this. Our culture's impact on this area of life is significant, and only becoming more of an issue in my opinion with reality TV and social media.

I don't want to sound like I have all the answers (or any answers!), this will always be a work in progress. But today, I'm thankful. I'm thankful to have the people I have along on this journey. Some have contributed significantly to the things I mention today. I'm thankful for you.

I'm going to link to a simple finding that I've discussed with a friend often. You can draw your own conclusions. Click on the next sentence to access it.

Comments

Post a Comment