The first real snow fall of the season - cue the Christmas music!

Things are still plugging along - I can't believe we're a week from Thanksgiving. I'm really looking forward to my Thanksgiving morning 5k and then replacing those burned calories with some delicious food with great company.

I'm happy to share that at the end of this month I will have hit a total of $20,000 knocked off of my total debt principle. It is also looking like I will have paid around $4000 in interest for the year, considerably less than the amount paid last year that became the namesake of this journal.

I can't begin to explain the impact this has had. Combined with the improvement in physical health, I'm as happy as I remember being in a long while. Some would say we're living deprived. I have more money in the budget going towards debt than our monthly living obligations and "fun" each month. I'm successfully living off of a take home income over 50% less than what it actually is. Combine this with owning a car that is worth less than two brand new high end smartPHONES (think about that for a second!). We have a house that meets our needs and nothing more, priced at the bottom of the market. And again, I'm incredibly joyful most days.

The family is healthy. Our basic needs are met, and we're able to afford a few things we "want". And we're all making positive progress towards the things important to us.

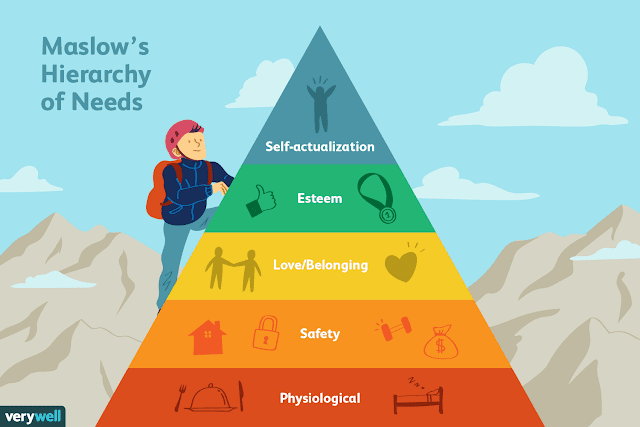

This often leads me to thinking about Maslow's hierarchy of needs:

I keep reminding myself to be careful of sacrificing more than necessary to chase things outside of these basic 5 categories. Do what you can to continually strengthen and ground yourself in the journey to the top.

Running - I didn't write last week, but I've run 26.75 miles in the past 2 weeks. I didn't get as many as I wanted because of a trip to NH and Virginia, but that's ok.

That's all.

Things are still plugging along - I can't believe we're a week from Thanksgiving. I'm really looking forward to my Thanksgiving morning 5k and then replacing those burned calories with some delicious food with great company.

I'm happy to share that at the end of this month I will have hit a total of $20,000 knocked off of my total debt principle. It is also looking like I will have paid around $4000 in interest for the year, considerably less than the amount paid last year that became the namesake of this journal.

I can't begin to explain the impact this has had. Combined with the improvement in physical health, I'm as happy as I remember being in a long while. Some would say we're living deprived. I have more money in the budget going towards debt than our monthly living obligations and "fun" each month. I'm successfully living off of a take home income over 50% less than what it actually is. Combine this with owning a car that is worth less than two brand new high end smartPHONES (think about that for a second!). We have a house that meets our needs and nothing more, priced at the bottom of the market. And again, I'm incredibly joyful most days.

The family is healthy. Our basic needs are met, and we're able to afford a few things we "want". And we're all making positive progress towards the things important to us.

This often leads me to thinking about Maslow's hierarchy of needs:

I keep reminding myself to be careful of sacrificing more than necessary to chase things outside of these basic 5 categories. Do what you can to continually strengthen and ground yourself in the journey to the top.

Running - I didn't write last week, but I've run 26.75 miles in the past 2 weeks. I didn't get as many as I wanted because of a trip to NH and Virginia, but that's ok.

That's all.

Comments

Post a Comment